Why your parents could afford a house on one salary – but you can’t on two

The American Dream was stolen—and you’re paying the price

By Paul Stone , Dave Erickson Fox News

Published September 18, 2025 7:00am EDT

Imagine your parents or grandparents buying a house, raising a family, and living comfortably – all on a single paycheck. Today, even with two full-time incomes, many Americans barely scrape by. What happened?

The truth, as exposed in "1971: How All of America’s Problems Can Be Traced to a Singular Date in History," is far more explosive than you’ve been told. This isn’t about inflation or changing lifestyles. It’s about a deliberate, top-down policy pivot that sabotaged the financial security of millions.

In August 1971, President Richard Nixon didn’t just make a routine economic decision – he pulled the rug out from under the middle class. By severing the dollar’s link to gold, the government unshackled itself from fiscal discipline, and Americans lost their last safeguard against runaway inflation. Overnight, your family’s savings became vulnerable, and the future was mortgaged for short-term political gain.

A single, calculated act in 1971 destroyed the financial foundation of the American middle class.

Before this seismic shift, a single breadwinner’s salary was enough to buy a home and provide for a family. After 1971, the rules changed – and not by accident. Wages stagnated, the cost of living soared and the price of housing shot skyward. Families were forced into the "two-income trap," where even double the pay couldn’t keep pace with the artificially inflated costs of essentials.

Today’s dual-income households are a symptom, not a solution. The system is set up so that, despite working harder and longer, American families are poorer than previous generations. The post-1971 era unleashed banks to flood the market with easy credit, driving home prices to ludicrous heights while real incomes froze.

The result? The American dream was transformed into a cruel joke – a game rigged so only the wealthy win.

Politicians and pundits will tell you, "That’s just progress." But the numbers expose the betrayal. A median home cost just $23,000 – four times the average household income – in 1970. Now, that ratio has exploded, with homes costing eight times what most families earn. You’re not failing; you’re being failed by a system that was reengineered to profit the few at the expense of the many.

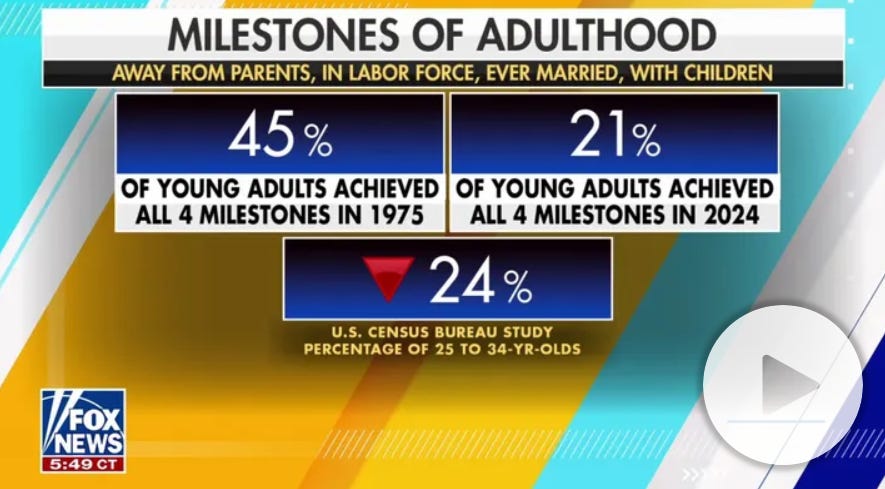

(Young adults lag behind 1970s milestones as parents shoulder costs, census says)

The uncomfortable truth: A single, calculated act in 1971 destroyed the financial foundation of the American middle class. And unless the rigged rules are confronted, the dream of homeownership – and a secure future – will remain a relic of your parents’ generation.

Yep, once the US no longer had to back dollars with gold, it enabled politicians to print money. And where did that excess money end up? Of course, it was siphoned out of the economy by corporations and channeled into assets (stocks, bonds, real estate, etc.), causing their prices to spike upwards. Housing prices accordingly spiked, forcing more people to go to work. And as the labor force expanded, it exerted a downward force on wages, it is like trying to climb a hill where each step causes you to slide back. They spun it as "women's equality" and such. They also killed labor unions, mainly by infiltration and sabotage.