The Next Up: Government Solution to Your Problems. MMT is Not The Answer

By Paul Stone

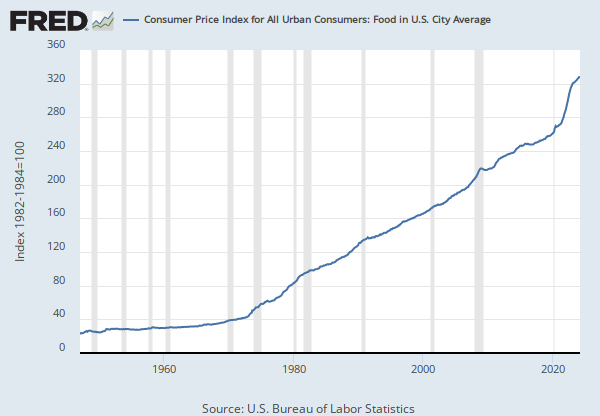

You know, when I hit the grocery store these days, like you, I’m amazed how little $100 buys. Prices have shot up—some items cost more than 50% than they did back in 2019.

Sure, I get it; manufacturers claim they have to pass on their increased costs like ingredients and transportation. But some of that is the silly game of “shrinkflation.” A corporate move is just insulting, but that could be the least of our problems.

While we all try juggling day-to-day challenges, there’s a much bigger storm brewing overhead—the growing national debt.

It’s a huge problem that’s barely getting the attention it deserves. It has the potential to really shake up our economic foundation. As I stand there in the store, weighing whether to pick up that slightly smaller pack of coffee, I can't help but worry about what all this means for future generations. Balancing immediate needs with long-term financial stability has become a daily grind. I know this - the government solutions always seem to be worse than the problem.

Reagan said it first and often, “The government’s solutions are worse than its problems.”

So here’s what's being talked about as the next solution… Modern Monetary Theory (MMT).

MMT is the new belief that money is a commodity. Like coffee or corn, Uncle Sam thinks he can create as much of it as he wants. FOREVER.. And the economy and the dollar will never die.

That is like if I eat half a Snickers candy bar today, then half tomorrow and still have another half the next day… and I’ll never run out of Snickers. I can keep splitting the Snickers for days and days, into the millennium - the problem is the Snickers won’t be as promised - “Snickers Satisfies” - it can’t be. It’s been split too many times. Devalued.

MMT suggests that countries like the U.S., which issue their own currencies, don’t face physical traditional financial constraints. Like turning water into wine! They say these countries can’t go broke because they can just print more money. Sounds freeing, right?

But it goes against everything that traditional economics has proven! For instance, all government debt that is never repaid, is seen as a recipe for disaster because it means they are not borrowing, they are literally stealing from Peter to pay Paul.

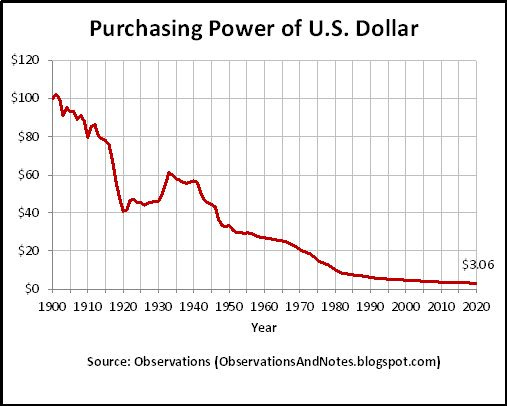

In this example, Peter is the hundreds of years our dollar would be worth something in the future. By printing money they are stealing the future value of our currency into the now to pay for things because the economy isn't producing enough money to cover its costs. It kills the dollar to create money artificially. Yet, MMT brushes this off, claiming that huge deficits might actually prevent recessions by boosting national savings.

So, the problem is our economy is NOT strong, as it does not operate in the black. Which is proved out by the fact the government prints money!

The solution to that is non-existent anymore, as the government over the last 50 years ignored this issue would exist one day so now the idea is “we’ll ignore physics and just say, “taaaahhh-daahhh.”

What worries me the most is how MMT utterly overlooks the fact that inflation is certainly caused by artificial money existing in the system. Inflation has endlessly grown since the Federal Reserve was created in 1913 - averaging 8% a year from the research I’ve done from the 1990’s to now.

Proponents of MMT believe this can be managed with certain fiscal policies, suggesting taxes be used not so much to fund government activities but more to cool down an overheating economy. To me, that’s a bit too wishful thinking. You know, the old saying, “put hope in one hand and sh*t in the other and see what fills up faster.”

Besides- how unbelievably arrogant is it to ‘theorize’ on something that flies in the face of physics?!?! You can’t have something for nothing… while risking our right for the “Pursuit of Happiness” for 340 million Americans.

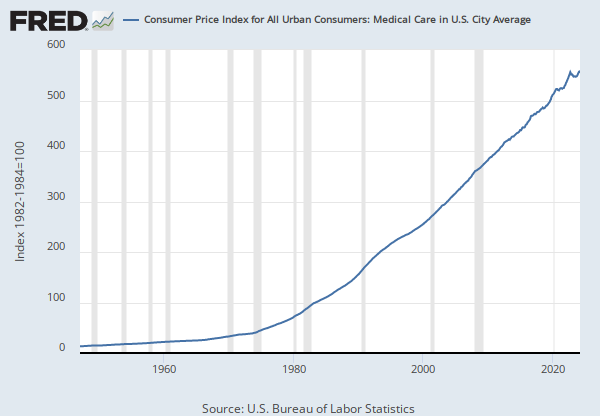

MMT isn't just a theory on paper anymore; it’s gaining traction, influencing politicians like Alexandria Ocasio-Cortez and Bernie Sanders, who use it to back big government programs like universal healthcare. The theory promotes the idea that as long as resources are available, spending shouldn't be restrained, which completely undermines traditional economic principles that emphasize budget balance.

Critics like Paul Krugman have voiced serious concerns, warning that MMT's reliance on the printing press could or would trigger hyperinflation, reminding us of some of the worst economic collapses in history. Despite these cautionary tales, MMT continues to influence economic discussions, advocating a drastic shift in economic thinking that could potentially destabilize our economic system under the pretense of modernization.

From where I stand, pursuing full-blown MMT would be catastrophic. It offers a seemingly simple fix to complex economic issues, but in reality, it could create significant instability.

No one has ever been here before to explain how it is proven rather than a theory.

MMT disregards the crucial balance needed to manage a country’s economy effectively, risking a lot for potentially little gain. As I mull over these points, the potential risks loom large. Yes, if they quit printing today there would be extremely painful consequences - because our society lives far, far outside its means. However, claiming money with no value can still support our living outside its means has no basis in anything proven.

Therefore, we still end up in utter catastrophe, but we lose the ability for choice-making. It's simply the nuclear option going full thermal and wouldn't we all be Pompeians when that volcano goes off.

This is not just about economic theory; the real-world implications are already visible in the rising costs and shrinking product sizes in stores. MMT’s approach could exacerbate these issues, leading to a scenario where constant money printing becomes the norm, not the exception.

MMT could devalue our currency, diminish savings due to inflation, and even reduce international confidence in the dollar. Imagine foreign investors pulling back, interest rates climbing, and a spiraling financial crisis.

By pushing for unchecked government spending as long as resources are available, MMT could lead to

wasteful public sector expenditures and

stifle private sector innovation and competitiveness.

And let’s not overlook the potential moral hazard—encouraging governments to rack up debt with the assumption it can always be printed away,

burdening future generations with higher taxes and lower quality of life.

The way MMT handles taxes, using them more as a tool to temper inflation rather than fund government activities, could also bring about unpredictable tax policies, complicating financial planning for individuals and businesses alike.

All these factors make me skeptical of MMT. It theorizes plenty, but at potentially great cost, challenging the very principles of prudent economic management and fiscal responsibility.

Reagan said it best - “The government's solutions are worse than its problems.” I can’t disagree with me. Looking at this it’s clear how one action, by the government, likely creates many many more problems.

As your dollar dies in value….

Commodity prices increase!

MMT is just another iteration of imperial colonial imposition coupled with the illiterate and child-like hopium that whomever has claimed this illiterate and illegitimate power - to create abstract units of representation of the value contained in other things that also by magical imperial decree (and generations of monetary illiteracy) possess value unto themselves - that this power will be used in the service of The People. It is like in the Middle Ages when the peasants hoped that the new king will be a good king and use his kingly powers in a good way while never questioning the existence of kings in the first place!

http://www.bibocurrency.com/index.php/downloads-2/19-english-root/learn/300-you-have-been-served

http://www.bibocurrency.com/index.php/es/downloads-3/15-spanish-root/301-ha-sido-notificado

Thank you for your insights. I'm currently a candidate for office in Idaho, where fiscal responsibility is paramount. With nearly 40% of our state's $13.9 billion budget relying on federal funds, there are valid concerns about our long-term financial stability. As committed conservatives, many of us are raising alarms about this dependence on federal funding. The looming question remains: how will Idaho sustain its 'balanced' budget once this nearly $5 billion source diminishes?

Your point about wasteful spending in the public sector resonates strongly with me. In 2023, Senator Glenneda Zuiderveld exposed a misappropriation of funds within Idaho's Department of Health and Welfare. Initially estimated at $10 million, this discrepancy has now swollen to approximately $71 million, resulting in several criminal prosecutions. Unfortunately, instead of addressing these issues head-on, the governor and his allies are resorting to underhanded tactics. They're leveraging PACs and special interest groups to thwart Senator Zuiderveld's efforts and push for the election of their own favored candidates. It's disheartening to see the establishment raise significant capital for this purpose, aiming to stifle the voices of liberty-minded individuals within our own party.

It's remarkable how the patterns of ignorance and corruption can transcend different levels of government. Whether it's at the federal, state, or local level, the fundamental issues often remain the same.