The Fed, Commercial Real Estate and Me

By Paul Stone

I’m mostly a country boy that went city. I get teased around the office (not just because of my flannel shirts) but for over-thinking, getting too worked up about… well, everything but usually it’s about the government's amazing ability to not think.

I don’t think you have to think too much to realize that what the Fed is doing is some crazy, irresponsible horse**it. Today they announced they were delaying the drop of the interest rates.

It sickens me as evil if we are left wandering around in the dark, if D.C. is not informing us of truths regarding the negative status or viability of things we count on.

I will not apologize for my viewpoint. Everyone in Washington D.C. works for us. Their actions must be to improve things for us, not a system, not even their own careers, but We the People.

(Once again I must say I am not making predictive or forward looking statements. Nor am I giving investment advice.)

To me, and certainly am wide open for better information but when it's not forthcoming it causes us to wonder, why would that information be hidden or murky or not front and center? Doesn’t D.C. work for us? In our minds they report to us, right?

My hope is to illuminate things I have questions about, perhaps you might have questions as well.

Let’s take a look at what the Federal Reserve has been up to lately. It doesn’t make me feel great. Honestly, it's not just a hunch. The signs are all over the place, kind of like déjà vu from those dicey days before the 2007 financial meltdown.

Back then, reports seem to indicate, there were many banks in need of funds and only the Federal Reserve would hand those funds over. Now I get that there are probably times when that situation isn’t a death spiral, could be a hiccup, and so once there’s bad news out there on a bank the public rushes in and makes the situation worse. But, the conundrum is: if D.C. works for us, aren’t we owed the unvarnished truth?

I don’t want to read anything into this but it seems with what we can gather and read for ourselves, the Fed was urging all banks to borrow money directly from the Fed so it wouldn't be alarming if just your bank was forced to borrow from the Fed. If banks, when in need of funds, have mostly always been able to borrow from other banks, and suddenly those banks get turned down , trying to make it seem okay for the ones really in trouble to do the same, masking from us, which were in ‘trouble’.

Well that was 2007-2011 per a report I can send out for anyone who requests. Today It's happening again. Knowing how we.the account holders. would likely react, can you blame the banks for being a bit shy about it? It’s not like your favorite football team you support even if they suck this year - this is your bank - your money - your security.

Nobody, especially financial institutions, want to look like they're the ones needing a lifeline—it's like hanging a "we might be in trouble" sign for everyone to see.

This whole push from the Fed again seems trying to prevent us from causing bank runs, which are pretty much a nightmare scenario with the way our banking system is set up. But by nudging the healthy banks to dive into these emergency funds, it feels like they're muddying the waters on purpose. Are they hiding the real score about which banks are teetering on the edge and how widespread it could be?

Then there's the whole saga with interest rates being so low for ages, making banks hoard U.S. treasuries that didn't pay much back. But when inflation kicked rates up a notch, those investments started to look pretty shaky, kind of like what happened with Silicon Valley Bank last year.

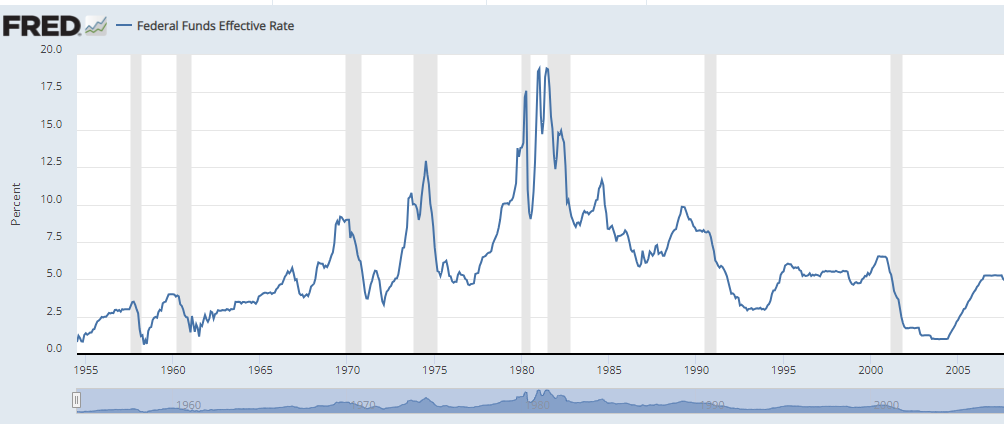

Here’s a look at our interest rate policy up until 2008.

Notice how the times the Fed cut rates they quite immediately began raising them again back to normal.

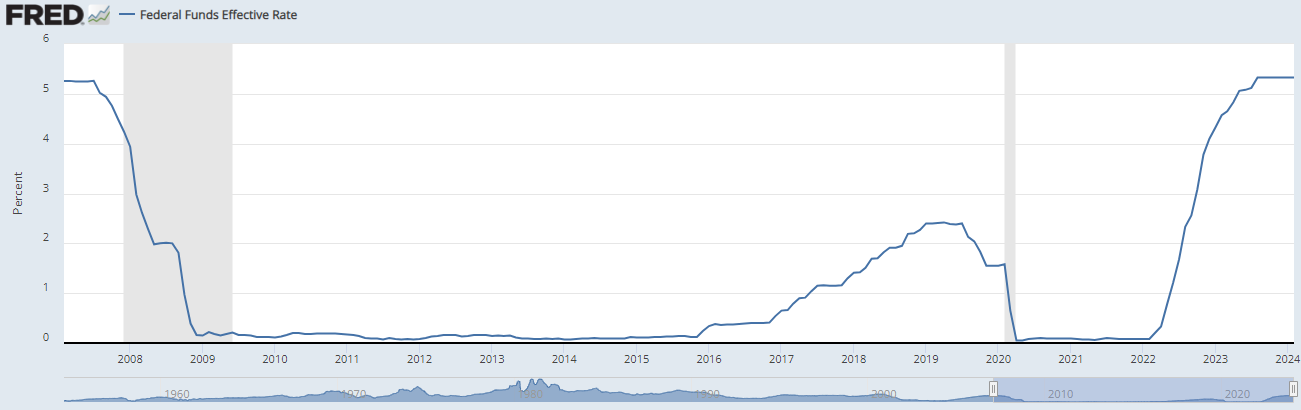

So what does this chart show 2008 until 2016? For eight years rates were at zero.

The gray bars represent Recessions.

To me, when the Fed cuts rates it's jumping on the gas pedal. Raising rates is getting on the brakes. It seems the world has been receiving a gusher of U.S. dollars at zero rates for about 8 years and once troubles showed up from Covid, per Tucker Carlson, the Fed created an equivalent amount of funds - issued onto an excel spreadsheet and out into the economy - becoming 40% of all the dollars on the books around the globe from 250 years of America incorporated. Could that be $40 trillion? $60 trillion? Of course we have inflation!

So now, raising rates, jumping on the brakes, to quell inflation is seemingly shafting banks, maybe where you and I bank. But policy is as stated above, to so it seems, mask the situation so we cannot tell if we really should worry or not and fails to inform us directly as we are owed that explanation of truth to then judge for ourselves if we will stay in the stands rooting for them to turn things around, like your football team… or will you want to know how your bank really is doing?

Now let’s look at commercial real estate. It was the golden child when everyone wanted a piece of property with a steady return. But then online shopping, folks working from their couches, and everything else that COVID brought along turned it into a hot mess. Now, those properties are like ticking time bombs on the banks' books.

The shift towards remote work isn't just a temporary blip; it's part of a structural change in how we do business. Offices that once buzzed with activity are now eerily quiet, forcing a reevaluation of what commercial real estate really means in this new world. The fallout from this could extend far beyond the banks, affecting pension funds, insurance companies, and even the mom-and-pop investors who've poured their life savings into what they thought was a sure bet.

After Silicon Valley Bank crashed, the Fed whipped up this Bank Term Funding Program, which was their way of saying, "Yep, we're kinda worried." But even with these moves, you've got folks like Fed Chair Jerome Powell and Treasury Secretary Janet Yellen talking up the economy like it's all sunshine and rainbows. Doesn't quite match up with the reality most of us are living or the measures they're taking behind the scenes.

Election year politics are just making the fog thicker, with everyone trying to sound upbeat about the economy. But peeling back the layers, it seems like the Fed's game plan might be to keep their options open to slash rates if things go south, choosing to prop up the banks over letting regular folks face the music of inflation.

Now Kevin O’Leary was wrong about Sam Bankman-Fried, but he’s been right about a lot more than he’s been wrong. So, let’s look at what he is saying about those 60 floors of air conditioned, mirrored, skyscrapers that have long been the banks' bread and butter.

Kevin O'Leary's take on the commercial real estate crisis just adds another layer to this whole mess. With more folks working remotely and a bunch of office spaces gathering dust, he's predicting a major shake-up. This could spell big trouble for the smaller banks knee-deep in these properties and, by extension, the small businesses banking on those loans.

To me, it feels like the U.S. economy is skating on thin ice. Despite all the pep talks from officials, the moves being made in the background tell a story of worry and caution. As we head into the next few months, it'll be key to keep our eyes open and not just buy into the feel-good spin.

The road ahead is filled with twists and turns, and it'll take some smart navigating to steer through what's coming. If you want to argue with me or tease me about my wardrobe choices—go ahead. Comment. Let me know what you think. I read all the comments and I’m always hoping to learn.

***If you want to argue with me or tease me about my wardrobe choices - go ahead. Comment. Let me know what you think. I read all the comments and I’m always hoping to learn something new.