Some Startling Facts of 2024 Economics in America

By Paul Stone

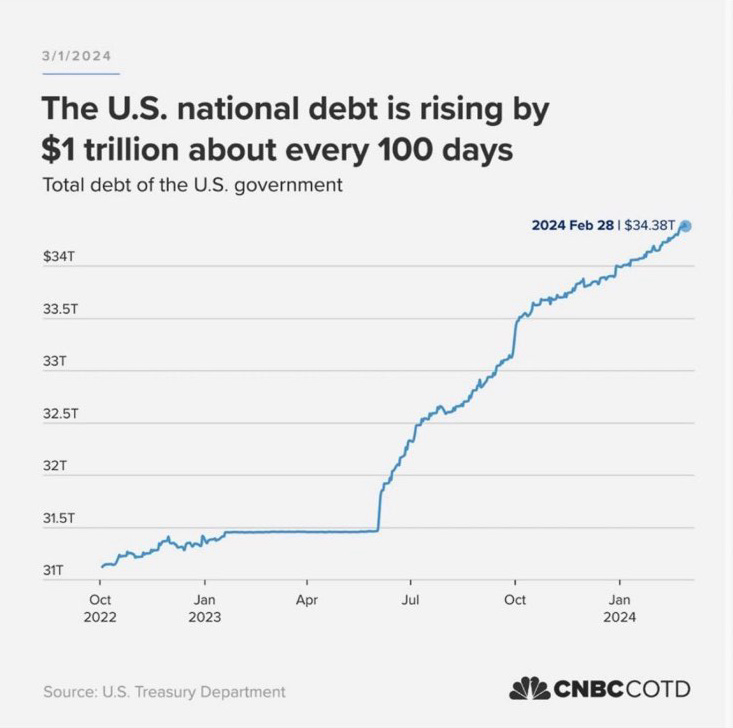

The United States' debt burden has been escalating rapidly, with an increase of approximately $1 trillion every 100 days. That is a FACT. A cold, hard fact.

And as I think about the current state of our economy and the discourse surrounding it, I am compelled to share a perspective that may not sit comfortably with many. The prevailing narrative around our national debt, particularly in Washington and among economic leaders, is, in my view, not just misleading but fundamentally flawed. To me, when using the word ‘debt’ within finances means money borrowed that will be paid back. Since it has been Washington’s practice now over many decades to not be capable of paying back the debt, I make the assertion that "It's Not Debt, If You're Not Paying It Back, It is Theft". This reflects a different perspective and it challenges the legitimacy of what is being presented as routine fiscal policy. It is not routine to owe $34 trillion. This situation with the Federal Debt is far from ordinary, and it's critical we understand the gravity of it.

What is most meaningful to understand next is “why? Why does there need to be $34 trillion in this ‘debt’? When you and I borrow, it is to acquire possession of something we cannot pay for in full at the moment we take possession, a car or a house for example. But, we as individuals, create revenue, we work in some capacity and money flows to us from our efforts. The government does not create, it simply receives or takes which is a totally different dynamic and they are not acquiring things, they are paying bills for things that are simply a cost. Therefore this $34 trillion exists because the economy cannot produce the revenue needed from the creation side to cover the cost side and so this then is never ending.

Well then how did costs exceed incoming money? Simply put, what makes sense to me is when we were thriving in a wholesome financial means, the baby boomers were working, creating revenue and America did not have the cost I am about to point out. When Social Security was created there were forty-two workers to 1 retiree. Today there are 3 workers. Obviously the government isn’t sensational when coming to predictions or planning but by 2050 there will be 2 workers for every retiree. This is the destructive force within our finances, America does not and how could it mathematically ever produce so much revenue there is still a profit after paying this cost with just 3 workers when it started with 42?

How is it that the brightest minds in our financial realm could overlook such a glaring issue? The national debt, which surpassed $34 trillion several years ahead of pre-pandemic projections, signals a dire mismanagement of our economic policies. The Congressional Budget Office, in January 2020, did not expect this threshold to be reached until fiscal year 2029. This acceleration is not just a number; it's indicative of a deeper, systemic problem that threatens the very fabric of our economy.

The national debt might not seem like a burden on the U.S. economy at the moment, given the continued willingness of investors to lend money to the federal government. This lending facilitates ongoing government spending on various programs without the need to raise taxes. However, this reality is built on a precarious foundation. The dollars created out of thin air since 2008 have averted a depression, but at what cost? This money, seemingly conjured from outside the economy, presents a false sense of growth and stability. It's a necessity, a crutch without which the lifestyle we've become accustomed to would crumble.

The arrogance and delusion within the human race, especially here in the U.S., have reached unprecedented levels. There is a pervasive lack of self-reliance and a deep slumber of awareness among the citizenry regarding these issues.

Joao Gomes, a respected finance professor at Wharton Business School, echoes these concerns, highlighting the potential economic turmoil from America's ballooning public debt. Predicting that this debt could destabilize global financial markets, Gomes's voice is among the few calling for immediate action. His warnings, supported by industry giants like Jamie Dimon and Brian Moynihan, stress the urgency of fiscal responsibility.

Yet, despite these alarms, there is a lack of political will to address the root causes of our debt crisis. The bipartisan nature of this issue, with significant deficits accruing under both recent administrations, suggests a systemic failure rather than a series of isolated policy missteps. Gomes's analysis, pointing to the waning confidence of foreign investors in U.S. debt securities, underscores the global ramifications of our fiscal irresponsibility.

The solutions proposed, such as boosting economic growth and implementing spending cuts, are fraught with political challenges. The avoidance of these tough decisions could lead us to a point of no return, affecting not just the U.S. but the global economy at large.

In pondering the essence of this crisis, the issue is not just the debt itself but the underlying causes that necessitate its existence. The reliance on "fake money printed out of thin air" is a symptom of a failing financial system, a system unable to meet its needs through genuine growth and revenue. This failure, at its core, is what we must confront if we are to avert a future economic catastrophe.

Get rid of the Federal Bank 🇮🇱